Experience

LONG-TERM CASH FLOW + IMPROVED RETURNS THROUGH A PASSIVE REAL ESTATE INVESTMENT

with Jacob Grant Capital.

City Heights

New Construction

- Open to investors

- Limited investment opportunity

- Construction to begin soon

Jacob Grant Forever Fund

Long-Term Private Fund

- Long-term growth

- Minimum tax exposure

- Passive real estate investment

Ruby Townhomes

Closed to New Investors

- Closed to new investors

- Full return of capital in 11 months

- Ongoing 18%+ return

Get Notified About Future Investment Opportunities:

Get notified about future investment opportunities:

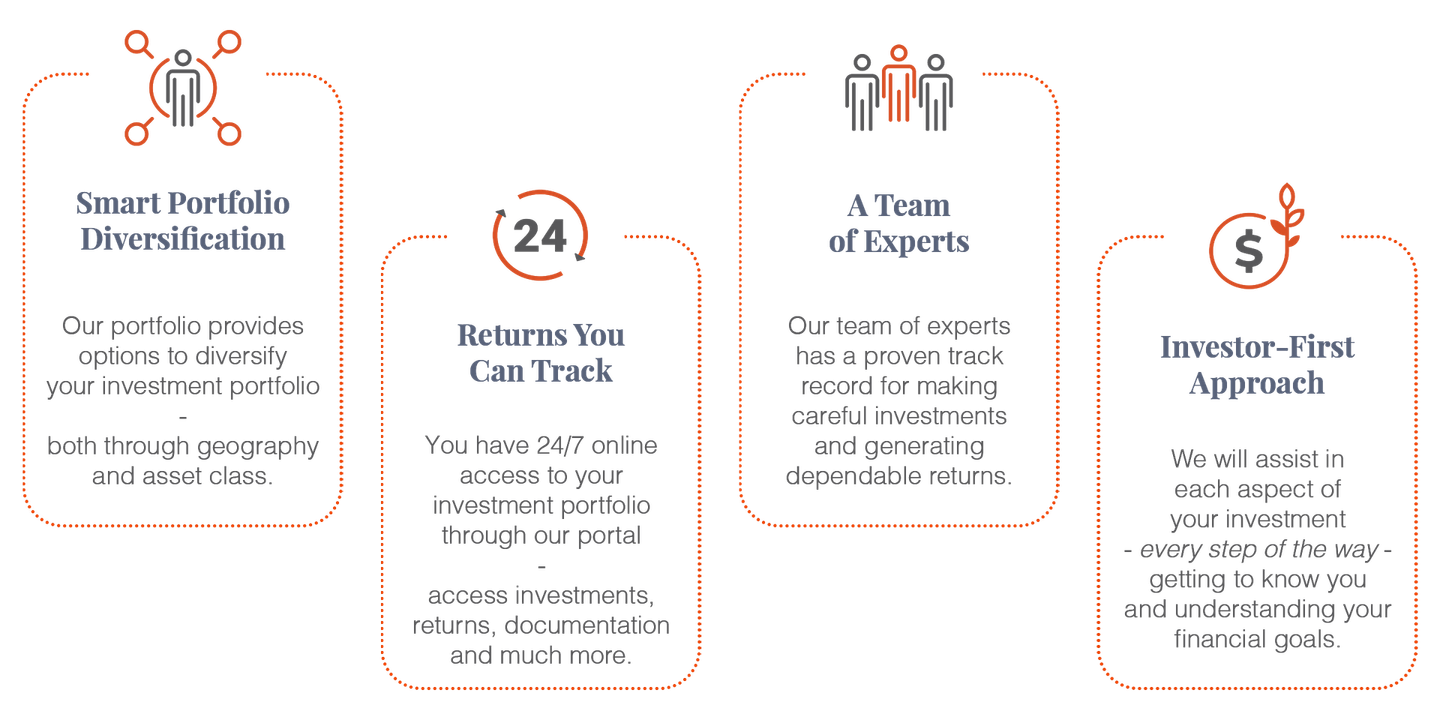

WHY US?

About Jacob Grant Capital

At Jacob Grant Capital, we are serious about investing in real estate and providing passive, long-term income for our investors.

With Jacob Grant Capital, you can experience the passive real estate investment you need to meet your future financial goals.

HOW DOES IT WORK?

Our Strategy

Investors who want long-term cash flow from a passive real estate investment can find what they are looking for through Jacob Grant Capital. Through the integration of property management, home services, and real estate investing, Jacob Grant Capital brings the best of all worlds to their investors.

Through proven strategies and Eastern Idaho investments, we are dedicated to choosing a top-performing geographical area for growth and stability. The area population is growing, and housing demand will increase consistently for the foreseeable future. With demand up and supply down, this is an excellent time to invest in the area.

Residential real estate investment is a stable asset class for any investor, and tends to provide a solid, secure performance even during recessionary periods. The growth of the "renter nation" began in 2008, with the economic and housing crisis that changed home purchasing and increased interest in multi-family properties. Those factors are still in play, and continue to gain strength.

The generation of equity in the properties held by Jacob Grant Capital comes through adding value over time. Making capital improvements to existing structures, and developing raw land for future use, are two of the ways Jacob Grant Capital experiences growth & increases security for investors. With a commitment to excellence and improvement, investors can feel secure in their choice.

Coupling investing with property management and home services improves investment value, which encourages the development and maintenance of existing and future residential and commercial real estate asset classes for the long-term.

JACOB GRANT CAPITAL TEAM

Meet Our Team

Jacob Durtschi

Founder, Acquisitions

Jacob Durtschi has been investing in real estate for 21 years in the Idaho Falls, Idaho, market. In 2009 he founded Jacob Grant Property Management.

Currently, the company manages $170m of residential real estate in the Rexburg, Idaho Falls, and Pocatello markets.

In addition to management and investing, Jacob provides development consulting on multifamily development, and reposition plans on poorly performing multifamily properties and has obtained the Certified Property Manager (CPM) designation from the Institute of Real Estate Management (IREM).

Mindy Cummings

Manager of Operations

Mindy Cummings has been in real estate for over 20 years, and managing investment real estate for over 12 years. Her experience includes all aspects of multi-family, single family, new construction, and repositions while directing operations on over 1,500 units in Idaho and Utah.

Mindy has excelled in maximizing profitability for investment portfolios and strategically working with investors to leverage her local knowledge and expertise.

Michael Kricfalusi

Chief Financial Officer

Michael Kricfalusi is a senior real estate professional and CFO with over 30 years of experience in asset management, acquisitions, dispositions, leasing, underwriting, reporting and financial analysis, including CFO for Columbus Capital and Foursquare Properties where he was responsible for the accounting of 100 simultaneous redevelopment and tax credit projects.

Michael’s role includes assisting in the evaluation and selection of new projects, acquiring debt and equity financing for each development and serving as the company’s liaison between its lenders and private investors.

What Our Investors Say

Fred D.

"A great company to work with! Integrity in everything that they do."

Brian D.

"I've had a great experience investing through Jacob Grant. I get regular updates on how things are going that are complete and thorough. They are looking at the long term through their expertise..."

READY TO MAXIMIZE YOUR INVESTMENT?

Access our Current Investment Opportunities.

Jacob Grant Capital (“JG Capital”) operates a website at www.jacobgrantcapital.com. By using the Site, you accept our Terms of Service and Privacy Policy. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All securities involve risk and may result in partial or total loss. Neither JG Capital nor any of its affiliates provides tax advice or investment recommendations and do not represent in any manner that the outcomes described herein or on the Site will result in any particular investment or tax consequence. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. Neither JG Capital nor any of its affiliates assume responsibility for the tax consequences for any investor of any investment. This message is not a proposal to sell or the solicitation of interest in any security, which can only be made through official documents such as a private placement memorandum or a prospectus. Only approved “accredited” or "sophisticated" investors (as defined by the Securities and Exchange Commission) may qualify to invest with us. If you would like to be considered for approval please fill out our contact form.