VACANCY TRENDS

Rates in Idaho Falls have stabilized over the past year.

We focus on value-add homes and multi-unit properties as well as ground-up multi-family assets that can be managed for long-term equity and cash flow growth.

Selling a property triggers a taxable event. Instead of selling, we prefer to continue to cash flow through down markets and utilize equity during up markets for strategic acquisitions that will generate cash flow and consistent returns for our investors.

The goal of this private fund

is to hold investment

properties long-term

to generate cash flow

and consistent returns.

| Minimum Investment | $50,000 |

| Preferred Return | 6% |

| Partnership Structure | 50% Equity split after Preferred Return |

| Distribution Frequency | Returns will be evaluated quarterly |

| Projected Annualized ROI over 7 years | 13% |

View all Offering details by downloading the Offering Brief below.

Jacob Durtschi

Founder, Acquisitions

Jacob Durtschi has been investing in real estate for 21 years in the Idaho Falls, Idaho, market. In 2009 he founded Jacob Grant Property Management.

Currently, the company manages $170m of residential real estate in the Rexburg, Idaho Falls, and Pocatello markets.

In addition to management and investing, Jacob provides development consulting on multifamily development, and reposition plans on poorly performing multifamily properties and has obtained the Certified Property Manager (CPM) designation from the Institute of Real Estate Management (IREM).

Mindy Cummings

Manager of Operations

Mindy Cummings has been in real estate for over 20 years, and managing investment real estate for over 12 years. Her experience includes all aspects of multi-family, single family, new construction, and repositions while directing operations on over 1,500 units in Idaho and Utah.

Mindy has excelled in maximizing profitability for investment portfolios and strategically working with investors to leverage her local knowledge and expertise.

Michael Kricfalusi

Chief Financial Officer

Michael Kricfalusi is a senior real estate professional and CFO with over 30 years of experience in asset management, acquisitions, dispositions, leasing, underwriting, reporting and financial analysis, including CFO for Columbus Capital and Foursquare Properties where he was responsible for the accounting of 100 simultaneous redevelopment and tax credit projects.

Michael’s role includes assisting in the evaluation and selection of new projects, acquiring debt and equity financing for each development and serving as the company’s liaison between its lenders and private investors.

Over $168,750,000 in real estate assets including new construction, multi-family properties, and single family homes under management in Eastern Idaho.

Coordination and project management of the maintenance for rehabs, flips and new construction in Eastern Idaho for over 20 years.

Finding solutions for real estate investors at all levels to increase net worth, generate cash flow, and develop an investment portfolio.

The Forever Fund Model

has been used for decades

by seasoned real estate investors through multiple market cycles.

Our current strategy is to allocate 80% of the fund to cash-flowing residential housing with a long-term hold view, and 20% to commercial and land assets with a medium- to long-term hold plan.

Residential Real Estate investments provide a stable asset class and tend to deliver a solid performance even during financial recessions. All the factors that led to the growth of the “renter nation,” beginning with the housing and economic crisis of 2008, are still in play and only getting stronger.

We expect to generate equity in our properties by adding value through development of raw land or capital improvements to existing structures.

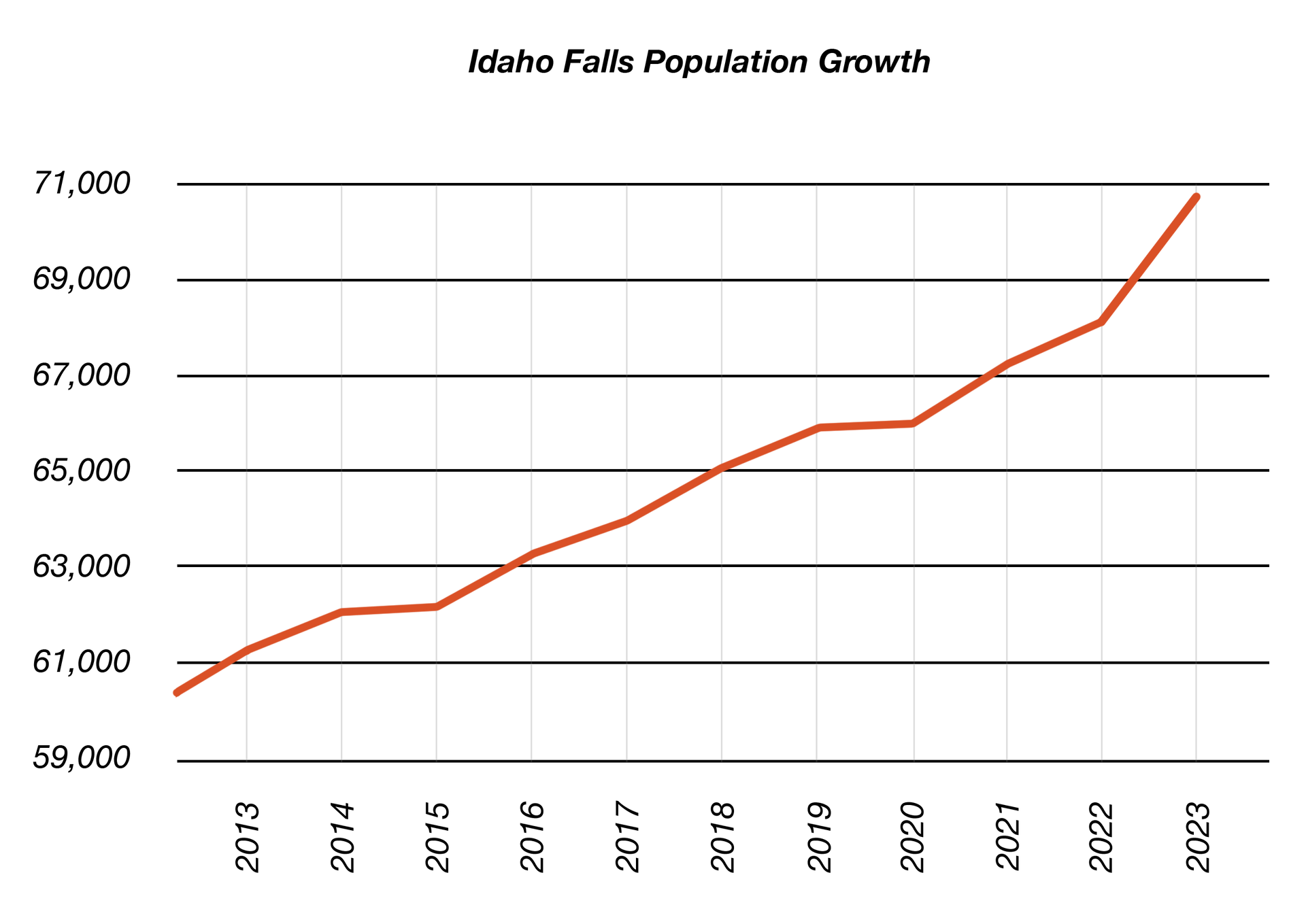

Idaho Falls is listed as

No. 1 on the Milken Institute 2023 and 2024

list of best-performing small cities.

Home to premier science,

technology and

research facilities.

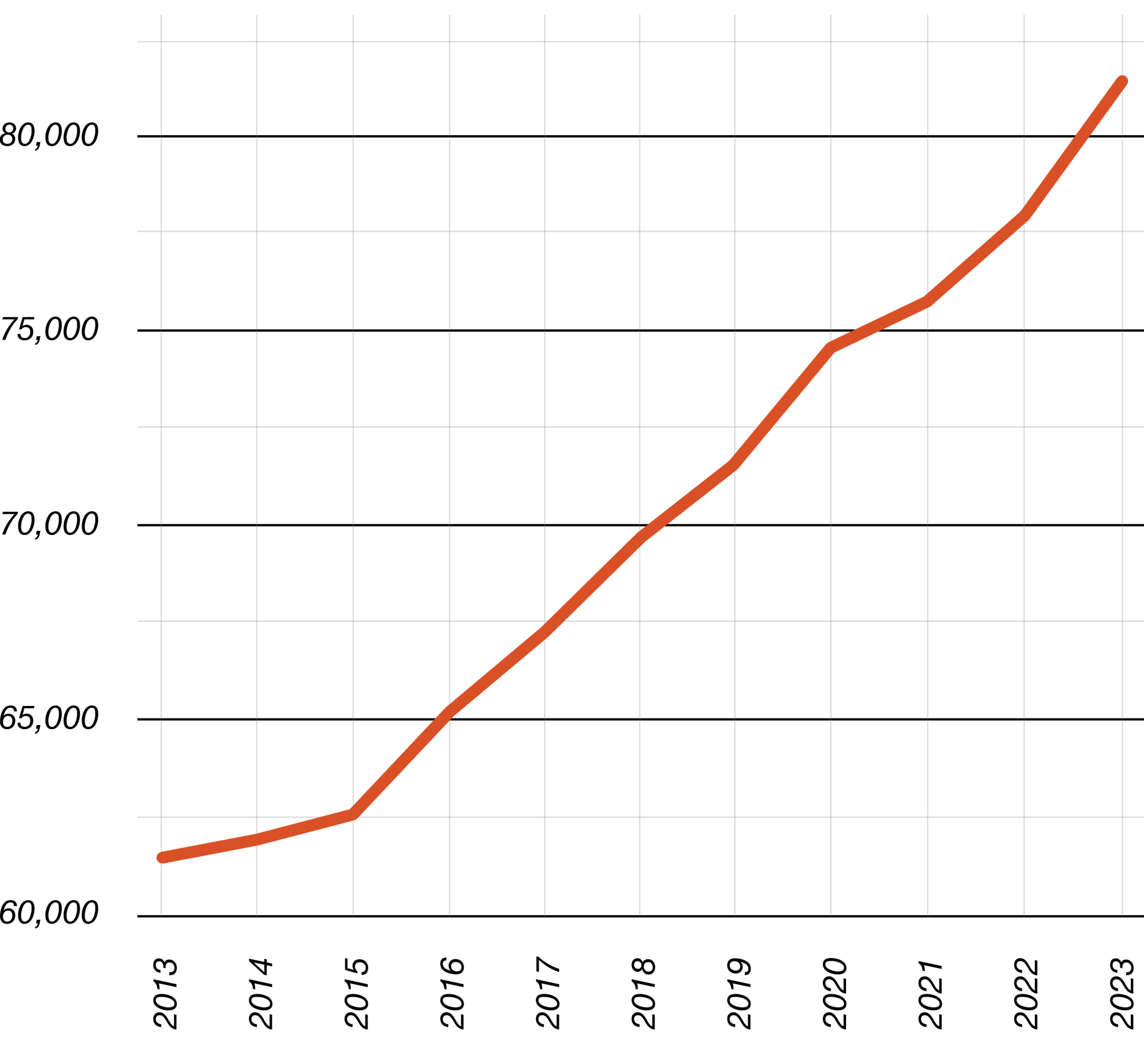

Eastern Idaho Labor Force

WHY WE INVEST in

Eastern Idaho

The area population is currently growing at a rate of 1.22% percent annually.

The increasing demand for housing — along with rising values and an undersupply of single-family residences — bode well for multifamily investing in the area.

VACANCY TRENDS

Rates in Idaho Falls have stabilized over the past year.

DEMAND

Delayed construction paired with limited inventory

is resulting in rising property values.

SUPPLY

A recent survey identified that currently,

builders are waitlisted.

DISCLOSURE + DISCLAIMER

This Investment Summary (the “Summary”) has been prepared solely for, and is being delivered on a confidential basis to, persons considering a possible business relationship with Jacob Grant Forever Fund LLC (“JG Forever Fund”). This Summary is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instrument of JG Forever Fund. No offer of securities shall be made except by means of a private placement memorandum meeting the requirements of The Securities Act of 1933, as amended, and applicable regulations of jurisdiction in which such an offer may be made. Any reproduction of this Summary, in whole or in part, or the disclosure of its contents, without the prior written consent of JG Forever Fund, is prohibited. By accepting this Summary, each participant agrees: (i) to maintain the confidentiality of all information that is contained in this Summary and not already in the public domain and (ii) to use this Summary for the sole purpose of evaluating a business relationship with JG Forever Fund.

FORWARD-LOOKING STATEMENTS

This Summary includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements include estimated financial information. Such statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the business of JG Forever Fund are based on current expectations that are subject to known and unknown risks and uncertainties, which could cause actual results or outcomes to differ materially from expectations expressed or implied by such forward-looking statements. These factors include, but are not limited to: (i) the inability of JG Forever Fund to secure sufficient financing on favorable terms to acquire and operate the targeted properties; (ii) the possibility that JG Forever Fund may be adversely affected by other economic, business and or competitive factors; (iii) an unexpected and unforeseeable event or events that adversely affect projections due to the economic climate, weather events, or events that uniquely affect acquired properties, including but not limited to litigation, latent building issues, or infrastructure issues; and (iv) other risks and uncertainties indicated from time to time in the final private placement memorandum prepared by JG Forever Fund, including those under “Risk Factors” therein, and certain other documents attached to and incorporated in the private placement memorandum for JG Forever Fund. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. JG Forever Fund undertakes no commitment to update or revise the forward-looking statements whether as a result of new information, future events or otherwise. Anyone using the Summary does so at his or her own risk, and no responsibility is accepted for any losses which may result from such use directly or indirectly. Recipients should carry out their own due diligence in connection with the assumptions contained herein. Although JG Forever Fund may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so whether as a result of new information, future events, changes in assumption or otherwise, except as required by securities laws. The financial and operating projections contained in the Summary represent certain estimates as of the date hereof. JG Forever Fund’s accountant has not examined, reviewed or compiled the projections and accordingly expresses no opinion or assurance that the projections contained herein will accurately reflect JG Forever Fund’s results of operation or financial condition. The projections are presented in non-GAAP format. Assumptions and estimates underlying prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause the actual results to differ materially from those contained in prospective financial information. Accordingly, there can be no assurance the prospective results are indicative of the future performance of JG Forever Fund or that actual results will not be materially different from the projections as presented. Inclusion of the prospective financial information in this Summary should not be regarded as a representation by any person that the projections contained herein are indicative of future results or will be achieved. These variations could materially affect the ability to make payments with respect to any of its outstanding and or future debt and service obligations.

INDUSTRY AND MARKET DATA

Unless otherwise noted, the forecasted industry and market data contained in the assumptions for the projections are based upon JG Forever Fund management’s estimates and industry and market publications and surveys. The information from industry and market publications has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of The included information. JG Forever Fund has not independently verified any of the data from third-party sources, nor has it ascertained the underlying economic assumptions relied upon therein. While such information is believed to be reliable for purposes used herein, none of JG Forever Fund’s, their respective affiliates, nor their respective directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to such information.